The Chinese Lesson: Online learning has no inherent churn problem

Chinese education technology companies have proven they can solve the #1 problem in online learning. Most people, however, draw the wrong conclusion from these successes.

Online learning programs in China post remarkable student retention rates. These results don’t stem entirely from a unique cultural phenomenon that we cannot replicate. Instead, homegrown innovation in product and business model have driven stickiness in this category. We can and should learn from China’s success in online learning.

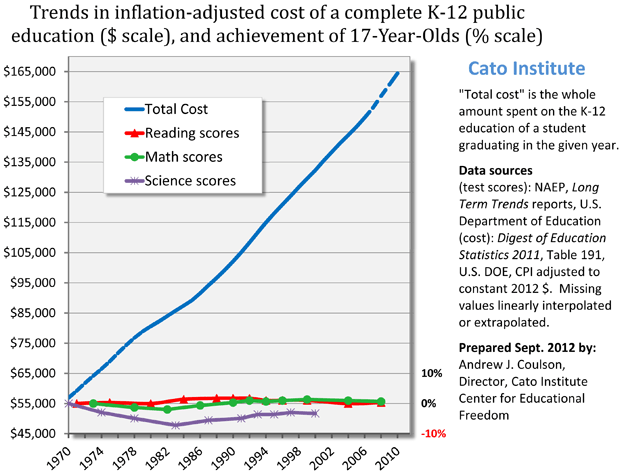

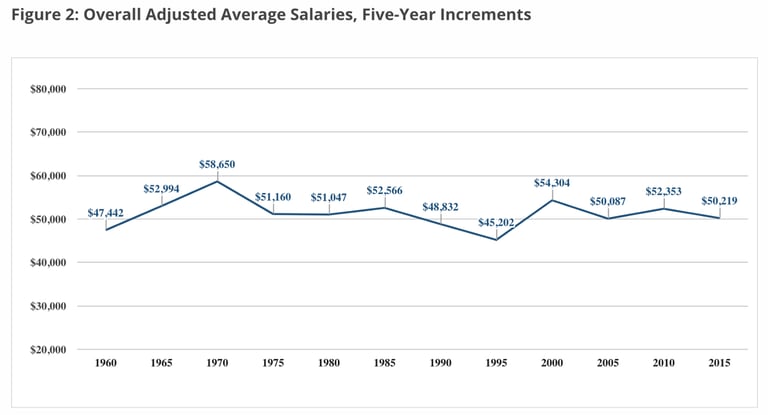

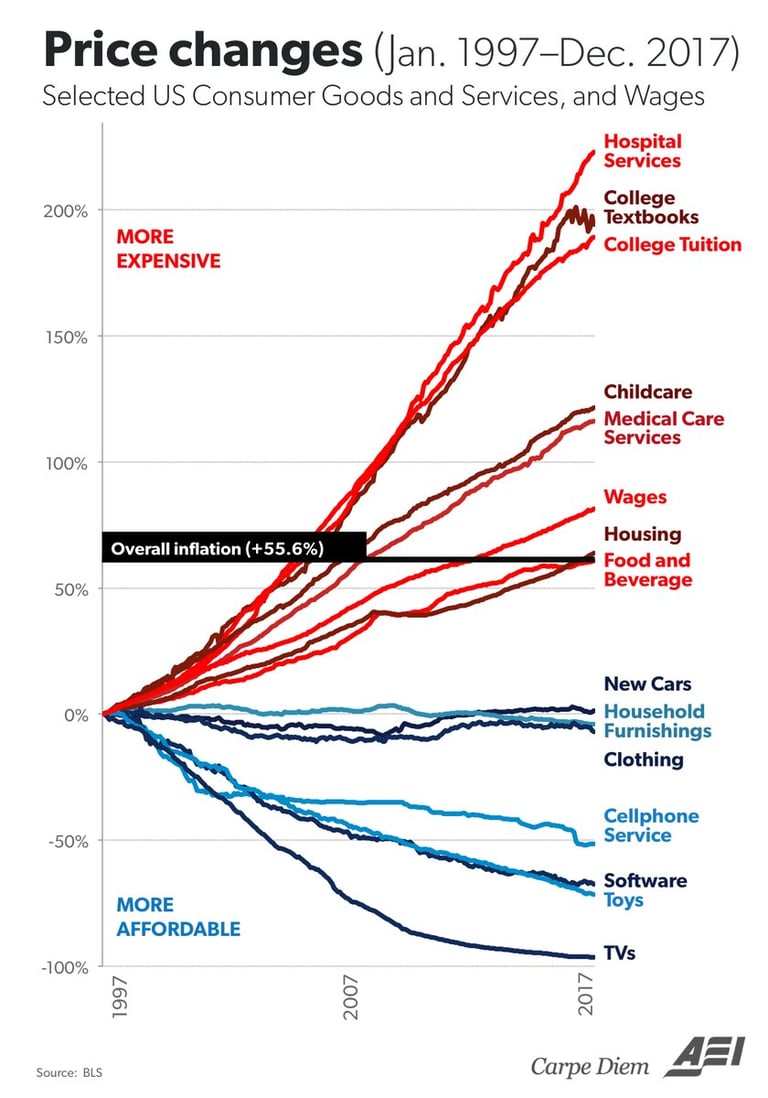

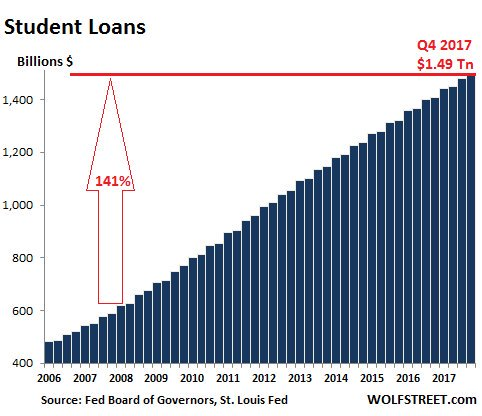

Here in the U.S., education has ballooned to a $1.3 trillion industry. 44 million Americans today have outstanding student debt. The aggregate balance of those loans more than doubled in the last decade. At the same time, the salaries of new grads flattened over the last 40 years. Overall, the data point to a bubble in the making; we shell out seemingly ever-rising prices without seeing any increase in value.

Then 5 years ago, Massively Open Online Courses came onto the scene. MOOCs promised to disrupt the old system, using the internet as a distribution and delivery method to democratize learning. A problematic pattern quickly emerged, unfortunately. Millions of curious learners enrolled in new programs, yet almost everyone quickly gave up. This caused Silicon Valley to cry wolf. A dearth of venture scale home-runs fueled a perception that “ed tech is hard” — a verdict previously reserved for sectors like cleantech, or hardware more broadly.

Meanwhile, 6,000 miles away, China cracked it.

Several of the Chinese online learning unicorns cite 95% monthly student retention. At that rate, 3 out of 4 students are still learning 6 months in, and over half are still learning beyond the one-year mark. An investor in one of the larger unicorns explained to us that in practice their students tend to renew through periodic longer-term commitments. Learners initially sign up for 6 months. 70–75% renew each 6-month renewal period, all equating back to around 5% monthly churn. At iTutorGroup, an English language tutoring company primarily targeting adult learners, the average student learns for 3 years, according to the company.

Industry insiders and VCs have chalked these results up to a common refrain: in China, education is religion. In the U.S., we are lazy and get distracted easily. They oversimplify.

While culture does indeed play a role in motivating us, this argument ignores a set of insights about what prevents an online student from giving up. Here are three such examples:

1. Humans are good at motivating learners. We just need to scale them.

VIPKid and Yuanfudao, two early Matrix Partners China ed tech investments valued at ~$3B each, have scaled in part by tiering their teachers across two different roles.

A content teacher teaches the material. These “head teachers” get paid more and may have new students for each class. They typically don’t build long-term relationships with individual students. In the case of VIPKid, native English speakers in the U.S. serve this function.

A second teacher type, a “teaching assistant” of sorts, acts as a hybrid between customer success and TA. They serve the critical role of keeping students motivated, dragging them along the program, helping with homework, and un-sticking them when they are stuck. They build a relationship with their students over time. VIPKid “TA’s” communicate with their students in Mandarin.

VipKid reported ~5 billion yuan in sales, or about $720 million by today’s exchange rate, in the last fiscal year.

Take-away: Offline, the best teachers excel at two things: (1) teaching content and (2) inspiring and motivating students. Online, we can decouple these two roles, thereby scaling our supply of educators further.

2. We can eliminate distractions online by leveraging unique content formats.

American podcast listeners largely expect to listen for free. We listen mostly for entertainment, to pass the time. The industry’s revenue totaled $300 million last year in the U.S., supported mostly by advertisements. In China, where content focuses on teaching new tangible skills that yield real-world outcomes, podcasting rakes in an estimated $7 billion annually.

Audio-driven education content can drive retention because of its ability to monopolize pockets of attention. Specifically, people can consume content in situations where focusing on a screen feels impractical or dangerous: while walking the dog, cleaning, running, cooking, or driving, etc.

As an example, De Dao, a premium audio content platform, contracts high-profile experts to record podcasts teaching topics in their field. Listeners navigate a marketplace of audio courses and subscribe to the ones they believe will get them (or their children) an “edge”: workplace communication, investing, accent reduction, Chinese history, etc.

Last year the company served 7 million customers. None of the content is free.

Take-away: screen-based learning competes with distractions like Facebook and Netflix for users’ attention. By making audio their primary learning consumption mode, people can fit courses into busy lives and more easily allow for a habit to form.

3. Brands focused on quality and outcomes support larger upfront commitments.

Most of us have a hard time walking away from sunk cost. Larger upfront financial commitments tend to make us likelier to see an endeavor through to the end.

Whereas most U.S. online learning platforms charge on a monthly pay-as-you-go basis, iTutorGroup charges for larger packages upfront. Typical packages range from 6 months to multi-year. Sales reps close these enrollments over the phone, offering a refund guarantee within the first month of learning in order to gel conversion rates. Because learners more or less see themselves forced to give the program a real chance, they achieve results more often than in programs with a lower barrier to entry. These results then encourage further renewals and strengthen a brand around learning outcomes.

The company had $350M in cash receipts last year with an 82% gross margin. Recently the company was reportedly raising at a $2 billion valuation ahead of an anticipated 2019 IPO.

Take-away: Big commitments can create a flywheel effect. Framing payments akin to “tuition” can train a potential learner to take their participation seriously. These commitments yield results in the form of learning outcomes, which turn into success stories that help a brand justify larger upfront commitments.

The offline education bubble will pop. Founders starting new companies in the category have an unprecedented opportunity ahead of them. At Matrix Partners, we’ve been lucky enough, in great part thanks to our colleagues at Matrix Partners China, to have a front row seat to what success might come to look like in the coming years. We’ve learned, among other things, that churn can be fixed. Of course, we are curious to hear what solutions founders in the U.S. will find to these same problems. They may look eerily similar or be completely unrecognizable. Point is, we’d love to learn more. Founders: please reach out if you believe you’re onto cracking this retention question, online learning’s holy grail.